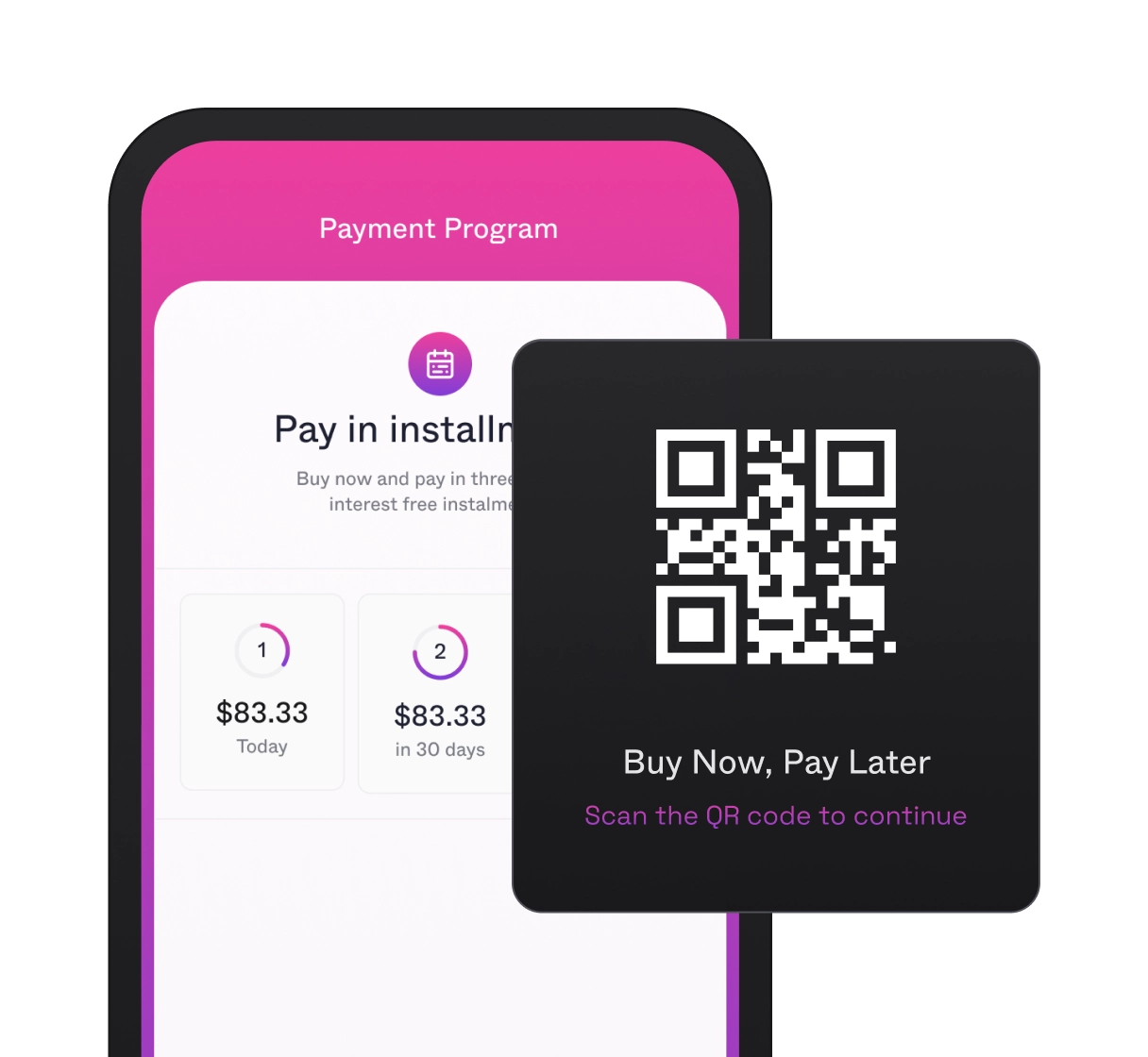

Buy Now Pay Later

Experience unmatched flexibility across diverse platforms and drive growth with our dynamic white-label Buy Now Pay Later (BNPL) engine.

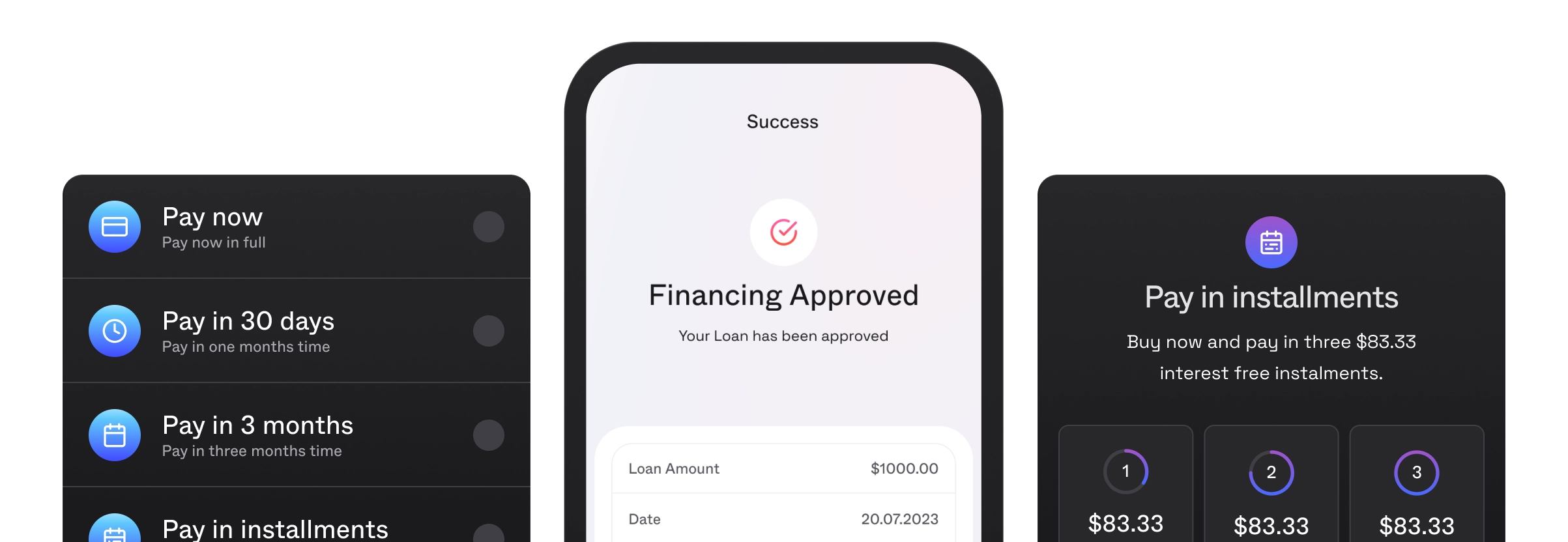

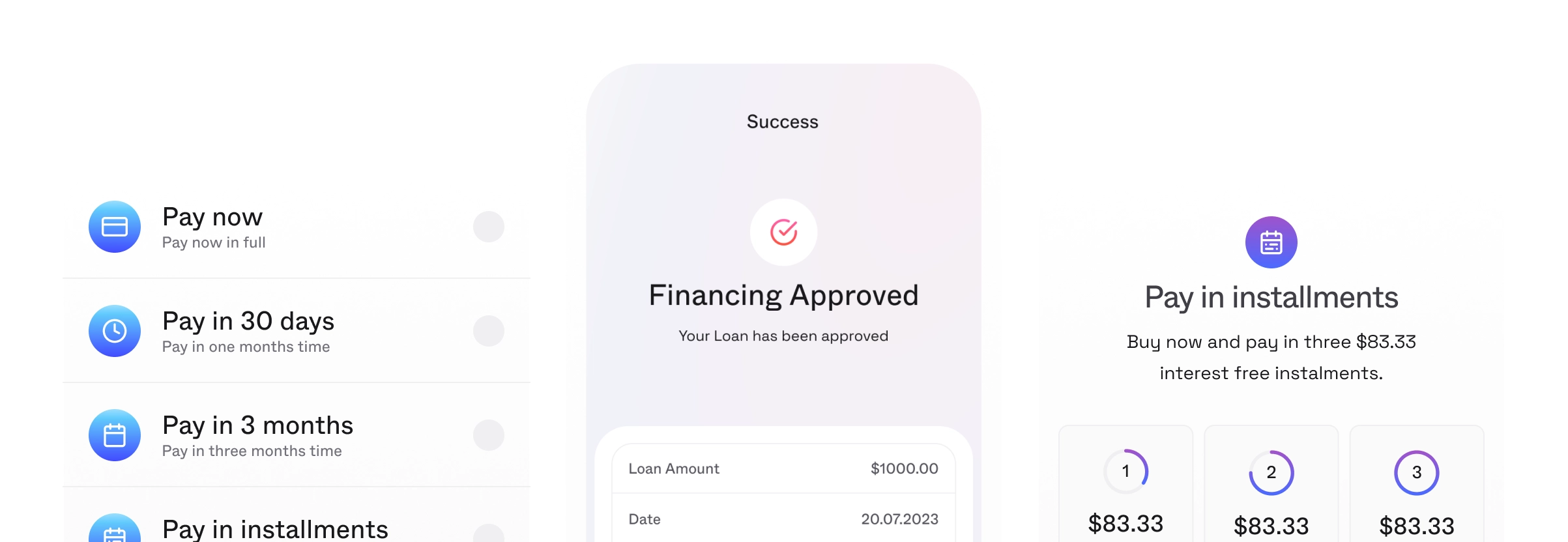

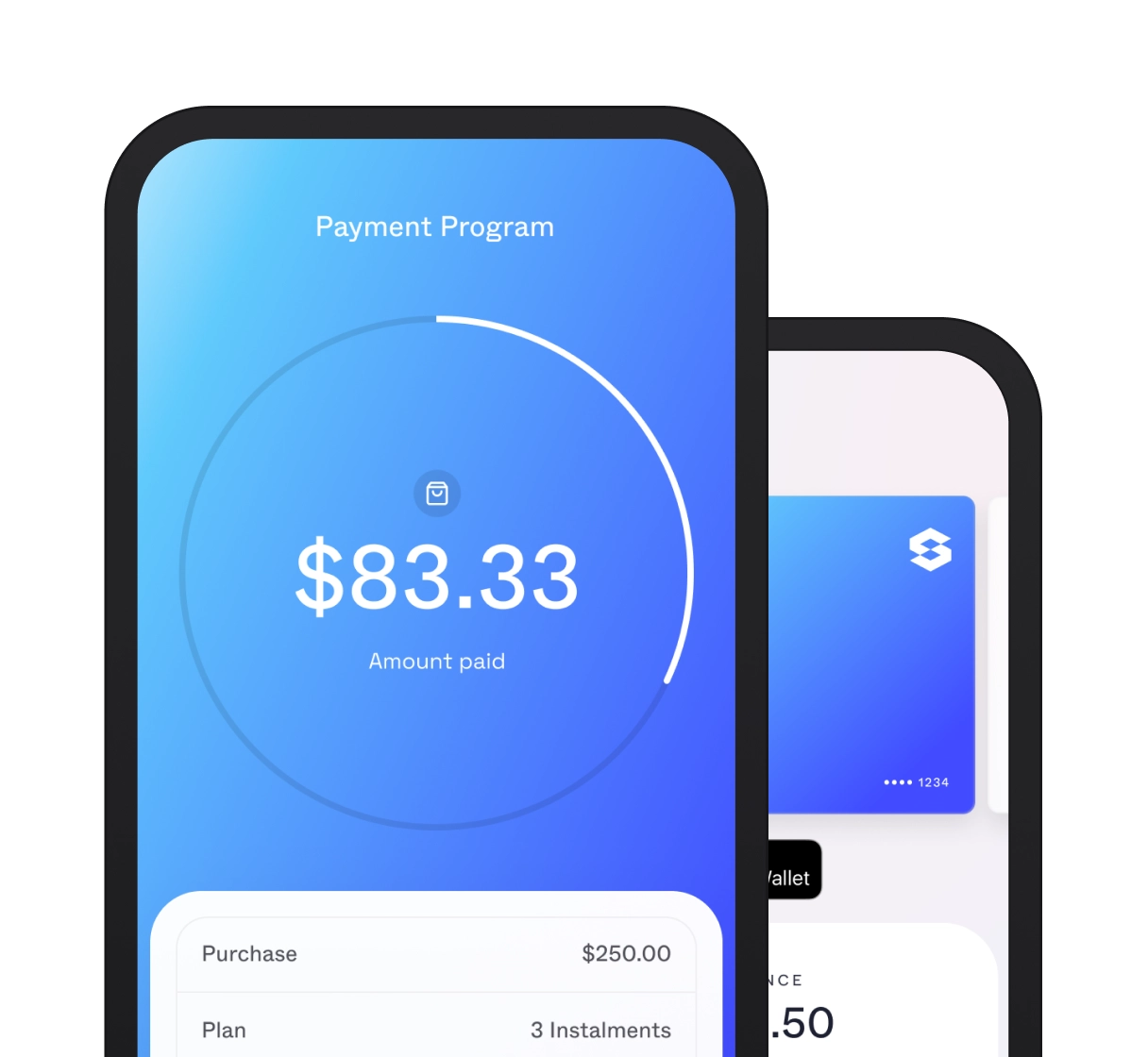

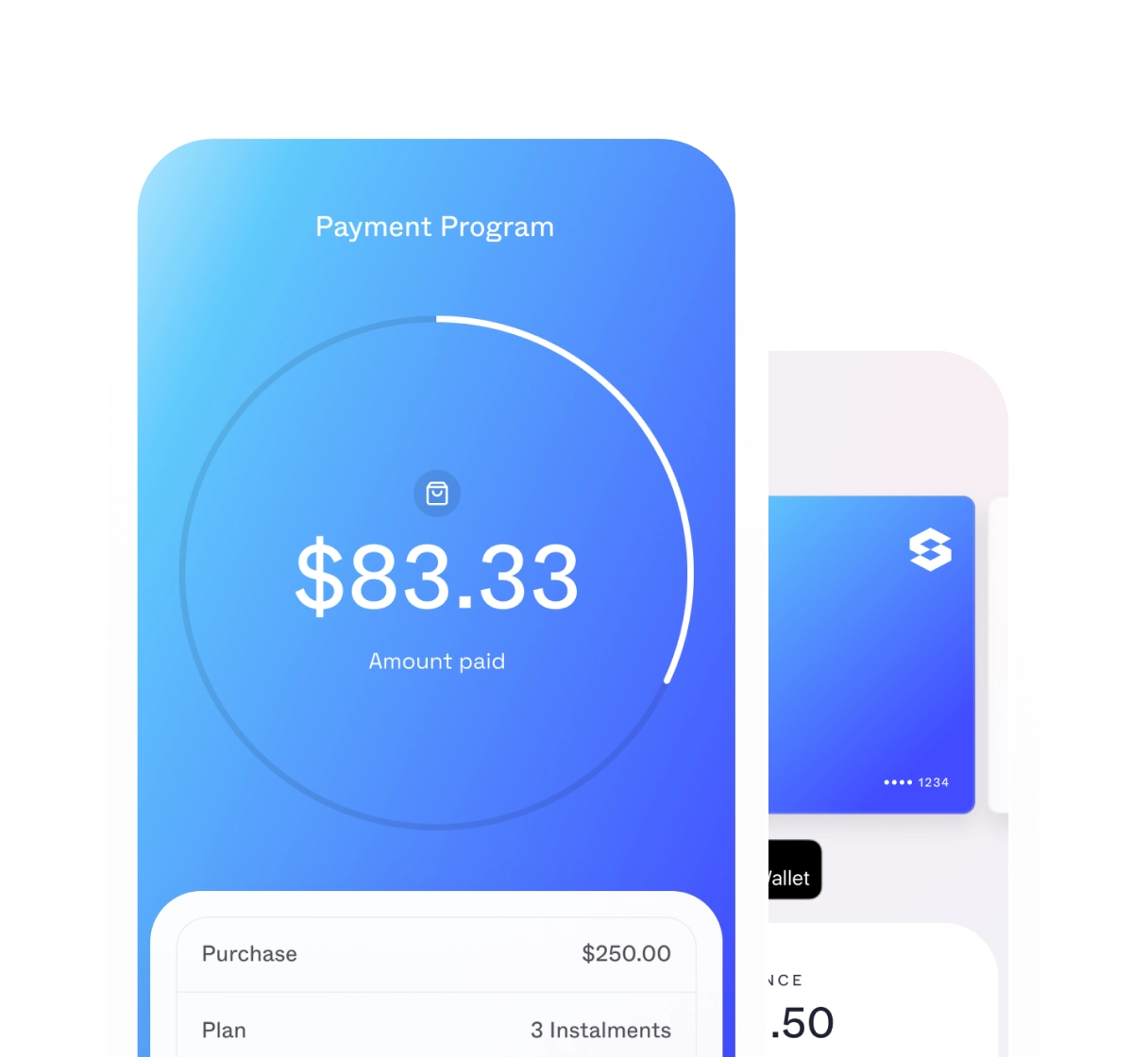

Provide A Flexible Payment Experience

Experience a BNPL solution built around your brand's unique identity, ensuring seamless interactions that resonate deeply with your customers.

Unlock New Revenue

Tap into innovative revenue streams by offering third-party integrations on our robust banking infrastructure.

Adaptive Technology

Staqs platform is endlessly flexible making it simple to seamlessly integrate with your existing technology

Future ready

With features like AI and machine learning, our platform is ready for the future of lending. Our platform is designed to foster innovation.

Cost-Effective Solutions

Streamline operations, reduce overheads, and elevate efficiency by leveraging third-party applications.

Data-driven Insights

Our integrations provide rich data, offering invaluable insights into user behavior and preferences.

Rapid Market Entry

Don't build from scratch. Use our platform to introduce new services swiftly and make an impact.

Flexible Payments, Zero Compromises

Unlock rich business insights, accelerate growth and delight your customers.

Key Features

Develop

Implement seamlessly

Staq's platform helps you automate your workflows from start to finish, so you can collaborate more effectively and efficiently.

Create card

Transfer

Create Account

curl -XPOST 'https://sandbox-api.staq.io/api/v1/partner/prepaid-cards/customers/#012345678/cards' \

--header 'Idempotency-key: 65d16950-1355-486e-8322-6002b713e0a6' \

--header 'Content-Type: application/json' \

--data '{

"CurrencyCode": "JOD",

"CardholderName": "John Self"

"MobileNumber": "0123456789"

}'